US Earnings Season - Positive surprises stimulate the markets.

The eagerly awaited reporting season in the US is almost over. With few exceptions, all companies in the S&P 500 have presented their figures for the first quarter. 78 percent of the companies exceeded analysts' earnings expectations. If you look at this figure without banks, it is even more than 80%. More importantly, however, is the news that analysts' fears did not materialize. It was expected that the decline in cumulative profits would be more than 6%. This did not happen, the decline in profits was only half as bad as expected and was only around 3%.

The second positive surprise came in the form of corporate sales growth. This was twice as high as analysts' estimates. In addition, there are signs that the recently declining profit margins are stabilizing. Companies have obviously done their homework and focused on efficiency improvements and productivity. The consensus estimates for the current calendar year (fiscal year) are now moving significantly upwards again following the findings from the first quarter.

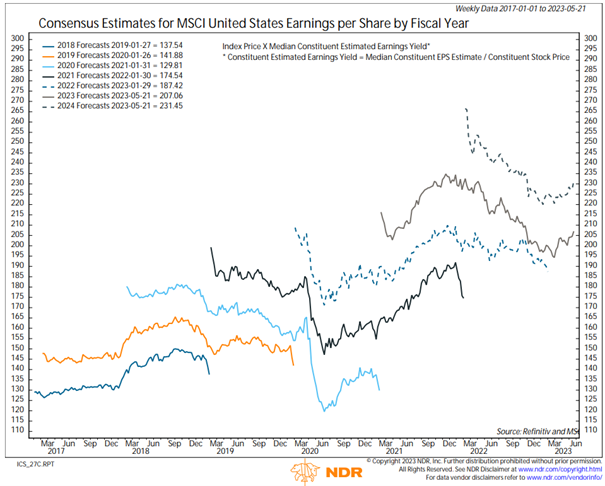

Source: Ned Davis Research

The chart shows the development of analysts' earnings expectations for the largest US companies. The analysts' earnings expectations for the current year (2023 = top gray line) have been declining since January 2022. This development was accelerated by the Ukraine conflict. For this year, analysts currently expect a profit of around USD 207 . At the beginning of 2022, these expectations were still significantly higher at around USD 235. In 2024, the low is then expected to be overcome and profits are expected to grow in double digits again (estimate for 2024: USD 231.45). These estimates represent the theoretical value per share at index level, reflecting the development of share returns in the index. The actual corporate profits generated may deviate significantly from analysts' estimates.

Currently, the financial markets are torn between uncertainties regarding the raising of the US debt limit ("debt-ceiling") and phenomenal figures from chip manufacturer Nvidia, the leading supplier of components for AI applications, which put the entire sector in the focus of investors.

In the longer term, however, it is still corporate profits that drive share prices - and the forecasts are promising. Next year, analysts already expect a double-digit increase in earnings per share for the S&P 500, although price fluctuations are always possible, as with all financial instruments.

In the Kathrein Mandatum funds and in the asset management mandates, we have already been positioned "bullish" again since the beginning of the month as far as the equity component is concerned.

Disclaimer

This information aims to provide a general overview of current market data as well as Kathrein's investment strategy and does not contain any direct or indirect recommendation for a specific investment strategy in the sense of a financial analysis.

When investing in securities, price fluctuations due to market changes are possible at any time. Analysts' opinions as well as figures and presentation of performance with reference to the past do not allow reliable conclusions to be drawn about future results.