The last step?

Author - Andreas Weidinger

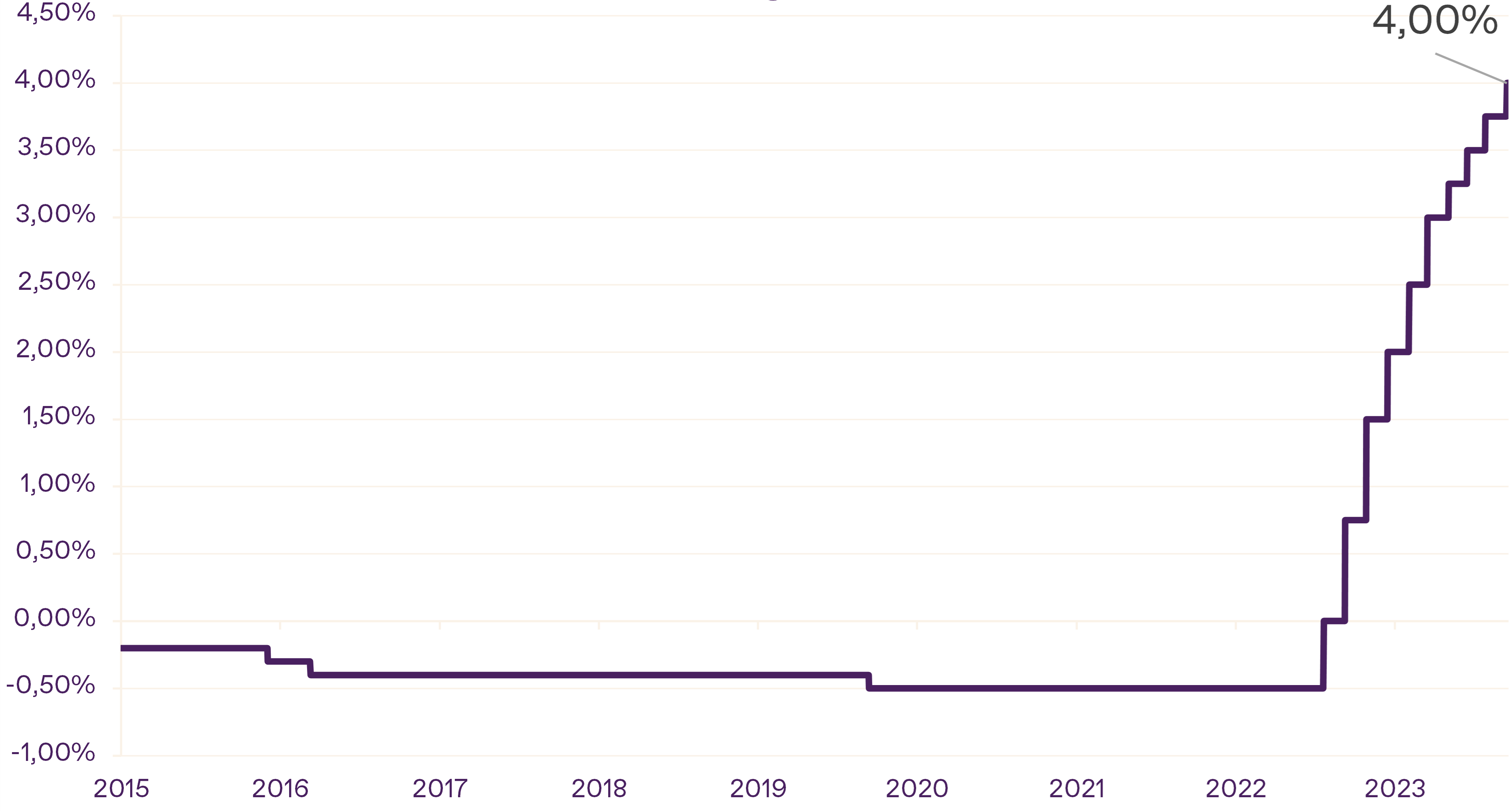

Was that all already, or is there more to come? Last week on Thursday, the European Central Bank (ECB) raised its key interest rates again by 25 basis points. The deposit rate at the ECB, which is the interest rate banks receive for their excess money when they store it overnight at the central bank, is now 4%, and the refinancing rate, at which banks can borrow money from the ECB for a week, was raised to 4.5%.

"ECB decides on tenth interest rate hike in a row" - this or similar were the headlines in the media. These headlines were often combined with the words "interest rate peak reached" or "reached the end of interest rate hikes". However, this development, which is not so pleasing for many borrowers, has at least raised the earnings prospects for safety-oriented investors again, and this after years of zero interest or no interest on their cash accounts. But was this really the final step?

Deposit interest rate of ECB

Summit postponements

The need for these interest rate hikes arose from the inflation rates across the euro area, which were well above 2% and had even exceeded 10% in some countries. Due to this inflation trend, which was initially seen as temporary, the ECB began its cycle of interest rate hikes in order to halt rising inflation rates for the time being and even reduce them slightly. Nevertheless, inflation rates for the euro area as a whole are still well above 2%. Even though they have fallen, this means "higher interest rates for a longer time" for us. Whereas at the beginning of 2023 interest rates were expected to peak in September 2023 and slightly lower rates were already expected toward the end of the year, the situation now looks quite different. On the one hand, we are well above expectations, and on the other hand, interest rates are not expected to peak until the end of the year, without a key rate cut in the first half of 2024 being priced in. Nevertheless, the capital markets are currently pricing in a first rate cut in July 2024. However, given inflation rates, this seems a bit too optimistic.

Now you may be asking yourself, "What does this mean for me, and what can I do now?" We can certainly make you an offer and invite you to talk to your private banker.

Disclaimer

This information is intended to provide a general overview of current market data and market developments and does not constitute a direct or indirect recommendation for a particular investment strategy in the sense of a financial analysis, or a recommendation to buy or sell financial instruments.

When investing in securities, price fluctuations due to market changes are possible at any time. Analysts' opinions, market opinions Data of the performance with reference to the past do not allow reliable conclusions to be drawn about future results.