Is there a trend reversal approaching for the stock markets?

Volatility on the stock markets remains high and sentiment continues to be at all-time lows. We are observing a large number of factors that, taken together, make us less optimistic that a sustained recovery will occur. But we deliberately want to take an optimistic perspective today. One set of factors that we are also keeping an eye on is seasonality and cycles on the stock market. There are models that certainly suggest a trend reversal in the near future.

Seasonality in the stock market - what is it?

Most readers will be familiar with "sell in may and go away". But there are many similar "rules" like this, depending on the time of year and seasonal events. The theory behind it: Stock prices behave differently at different "seasons". We know many such phenomena here, which have also been studied scientifically. Examples are the "Halloween effect", "End of the Month effect", "Four-Year Presidential Cycle" etc.

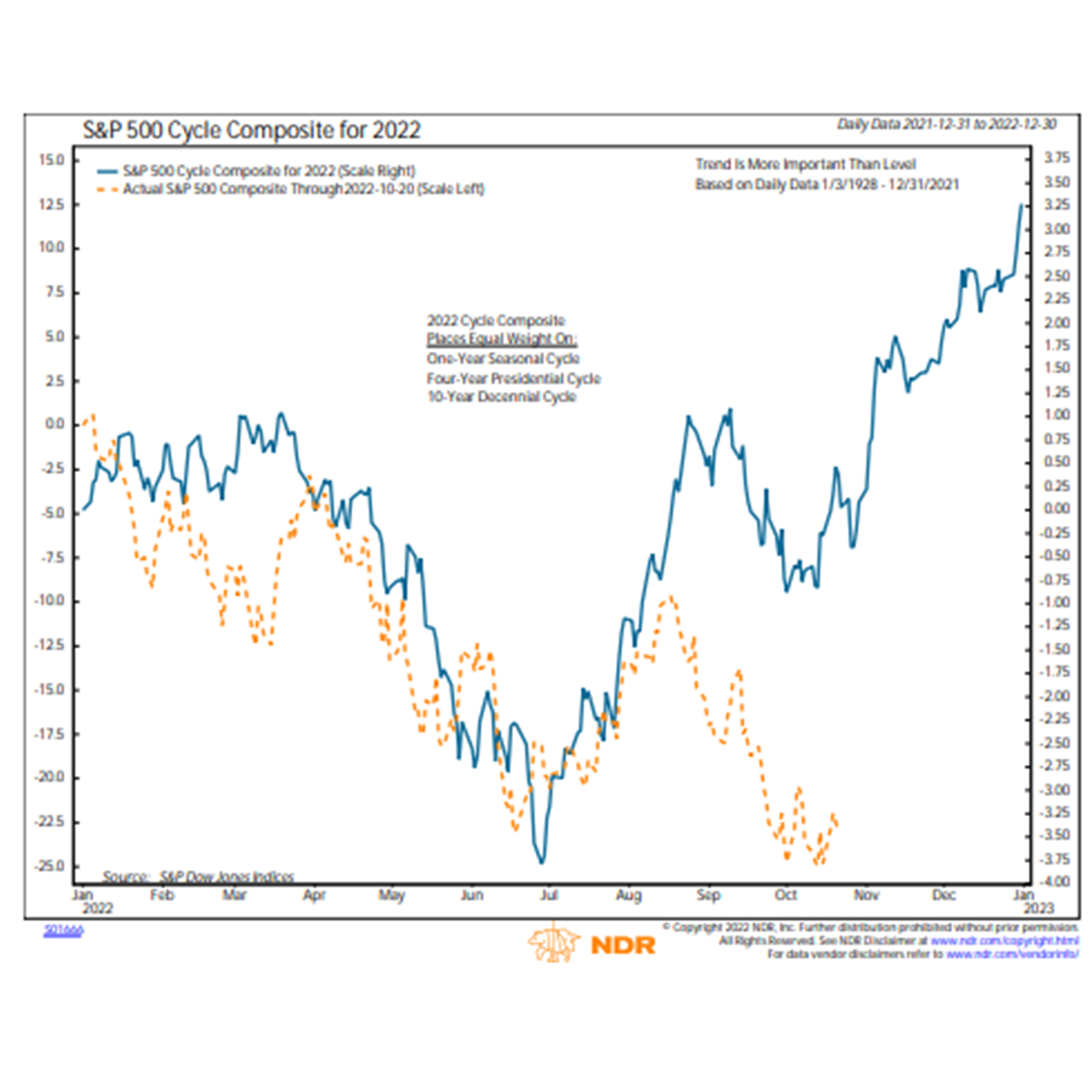

The independent research provider Ned Davis Research (NDR), a long-time partner of Kathrein Privatbank, has created a cycle chart for the U.S. stock market composed of repeating historical market patterns. A one-year seasonal cycle is calculated for the U.S. stock market (starting in 1928, daily data) and combined with 4 ("Presidential Cycle") and 10 ("Decennial Cycle") -year cycles to obtain a representative average year pattern ("Cycle Composite"):

The trend is more important than the level

The performance of the S&P 500 Index so far this year is shown in orange. Although there are of course strong deviations from the historical pattern, the picture shows that the trend is reasonably well represented. And the goal of the model is primarily to map the trend, not the level, i.e., the exact level of prices.

While the first four months of 2022 did not follow the pattern, the "Sell in May" rule was quite successful this year. The recovery in the summer was somewhat more muted. The subsequent decline also marked new lows for the year.

Knowledge of historical market trends can often provide a useful perspective on potential turning points and trends. However, the positive trend in the "Cycle Composite" alone is not a signal to buy for us; it only gains additional weight if it were confirmed by other timing models and indicators. Currently, this is not the case, as the majority of technical and micro/macro-economic indicators we track do not yet provide buying signals, which is why we continue to underweight the equity component in the managed portfolios/funds.