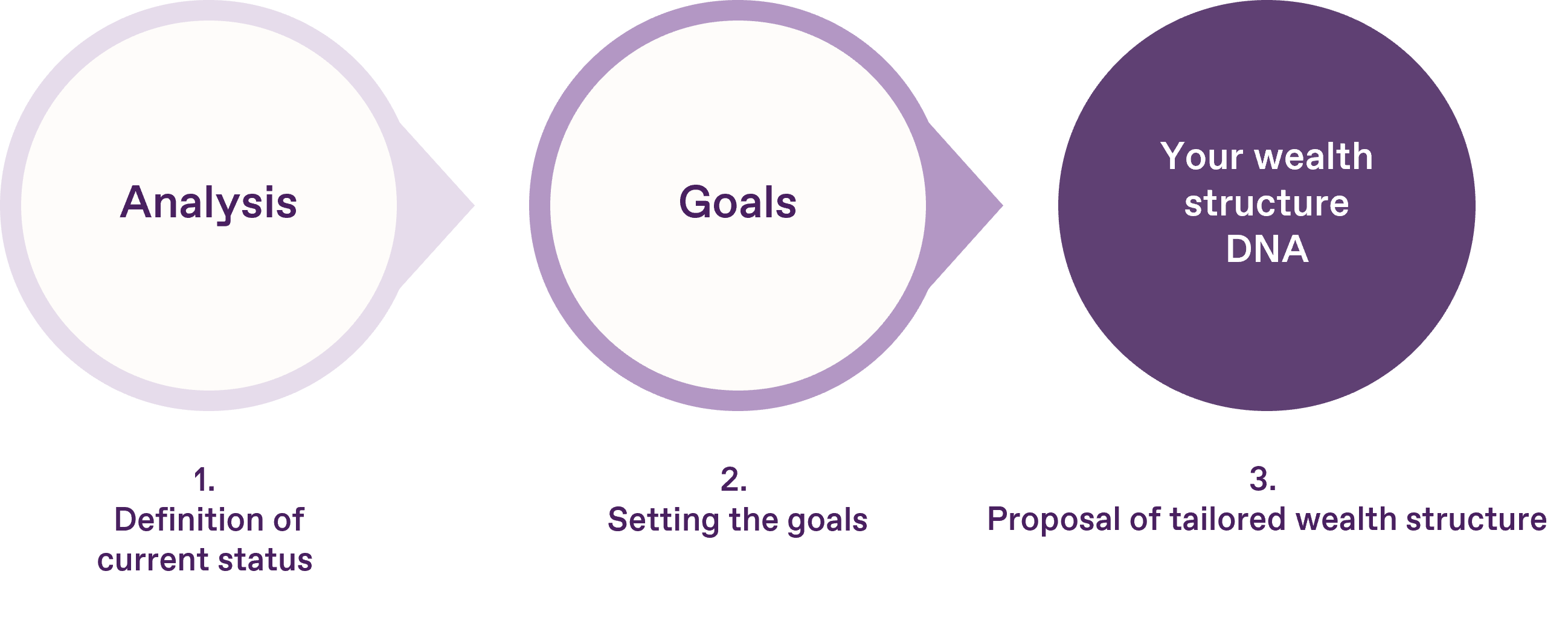

Wealth Structuring

Step 1: Analysis and Definition of the Current Status

We will define the current situation together with you by evaluating:

- all assets (e.g., securities, business investments, real estate)

- the legal and tax structure of the assets

- other conditions (e.g., family structure, future planning)

- personal preferences.

Step 2: Defining the Goals

In our needs analysis, we proceed thoroughly and with foresight. Together with you, we will discuss, among other things, the following questions:

- Can the current asset structure be changed/optimized?

- Should shares be consolidated or protected from possible fragmentation?

- How can the existing assets be optimally structured in terms of asset succession? Should certain heirs be excluded/favored?

- How can asset transfers to family members be optimally structured on an ongoing basis?

Step 3: Your Personal Wealth Structuring

Personal asset structuring is as unique as DNA. The asset structuring provided by Kathrein Family Konsult offers a tailor-made and personal solution for each client.

It consists of the following aspects:

- Asset planning

- Succession planning

- Legal planning

- Tax planning

- Special topics

*The services mentioned do not constitute legal or tax advice, which is reserved especially for lawyers, notaries, and tax advisors, and cannot replace such advice when needed.

Mag. Clementine Michalek-Waldstein, StB & WP

HEAD OF KATHREIN FAMILY KONSULT

Languages: German, English

E-Mail: clementine.michalek-waldstein@kathrein.at

Phone.: +43/1/534 51-235

Clementine Michalek-Waldstein heads the Kathrein Family Konsult team.

She has more than 20 years of experience in tax consulting and auditing, most recently in an Upper Austrian industrial company and before that in a management position in a tax consulting and auditing firm in Vienna. In the course of her career, she has been responsible for providing comprehensive advice to foundations, family offices and wealthy private clients.

Clementine Michalek-Waldstein studied at the Vienna University of Economics and Business and at the HEC Paris and graduated as a tax consultant and auditor.