Why Home Bias Should Be Ignored in Investment Decisions

Author - Michael Wilnitsky

Domestic investors tend to invest in securities from Austria that they know and understand. However, upon closer examination, this is by no means solely an Austrian behavioral pattern but a global one. This phenomenon, known as "Home Bias," affects investors worldwide. "Bias" is the English word for distortion. In investment, the distortion lies in investors basing their behavior not only on rational but mainly on irrational reasons.

Trust Distorts

Often, this phenomenon, addressed in behavioral finance theory, is associated with increased trust in the domestic market. Investors feel more comfortable selecting industries and companies from their region whose brands and business models they know or are familiar with from their daily lives. In some cases, this seemingly reinforced trust in domestic companies can also be explained by a direct connection to employees or stakeholders of these companies. Moreover, homeland pride or a certain degree of patriotism plays a role in investment decisions.

However, a portfolio with a pronounced Home Bias can bring disadvantages and increase risk. After all, portfolio theory suggests that only broad geographical diversification, through the construction of a so-called market portfolio, reduces country-specific risks and leads to low volatility. Portfolios with a strong Home Bias, on the other hand, are inadequately diversified and contain unnecessary country, sector, and factor risks.

Reducing Risks

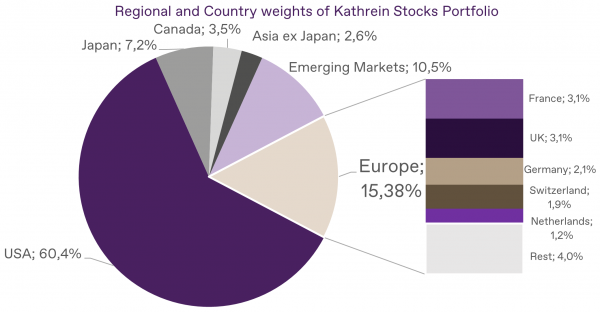

Diversification is therefore crucial for sustainable investment success and applies not only to asset classes but also to regions, countries, sectors, and currencies. The stock portfolio at Kathrein places significant emphasis on this. It should be noted, however, that a broadly diversified stock portfolio, reflecting the global economy, is determined by so-called market capitalization. The market capitalization of a country is determined by the total value of all stocks of listed companies in that country.

Consequently, the USA holds the largest share in a broadly diversified global stock portfolio, followed by Japan, Great Britain, and France. Austria, however, plays a subordinate role in the overall stock market, never accounting for more than 1% in the Kathrein stock portfolio. Currently, we hold no Austrian stocks.

As of: March 28, 2024

Through broad diversification, risks can be better managed, and potential returns optimized, while it is important to note that investments in securities are subject to price fluctuations. However, when building a diversified portfolio, not only the location of listing should be considered, but also other factors. Our experts at Kathrein Private Bank are available to comprehensively analyze your portfolio and provide appropriate recommendations for action.

Disclaimer

This information provides a market overview. It does not contain any direct or indirect recommendation for the purchase or sale of gold or securities. When investing in gold or securities, price fluctuations due to market or currency changes are possible at any time. Performance representation based on the past does not provide reliable indications for future results.