Who´s afraid of New All-time Highs?

Author - Florian König

The upward trend in the stock markets remains unbroken. Once again, the stock indices on both sides of the Atlantic reached new highs in recent days (Source: Bloomberg, 12/6/2024). Remarkably, one crisis or another leaves hardly any traces on market sentiment. The election victory of Donald Trump in the US presidential elections continues to resonate. Promised deregulation, tax cuts, and a strengthening of the US economy are still providing noticeable tailwinds at the end of the year.

All-Time Highs Are No Cause for Concern

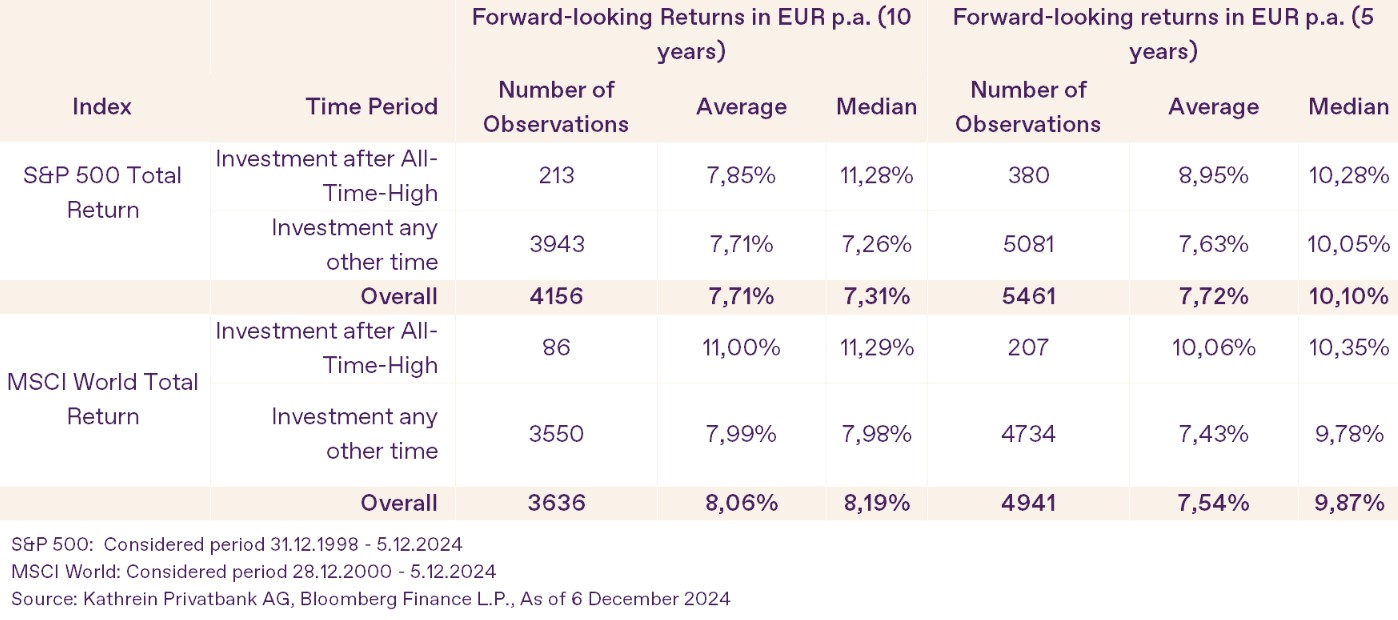

Anyone now questioning market timing and whether it is disadvantageous to enter the stock markets when they reach new highs has recent history on their side - at least partially. The past 25 years have shown that there is no unfavorable entry point for long-term oriented investors. The following table shows the development of indices after an all-time high and at other times, based on rolling periods of five and ten years. It summarizes the key figures of this analysis. Both over ten years and over five years, the average annual total return in euros after an all-time high is at least as high as at other entry points. This applies to investments in the broad US market as well as to global stock markets. From our perspective, an all-time high is therefore no reason to wait for a better time. However, what applies to the global stock market and the S&P 500 does not apply to other indices. These results cannot be confirmed for Germany or France.

German Emotional Chaos

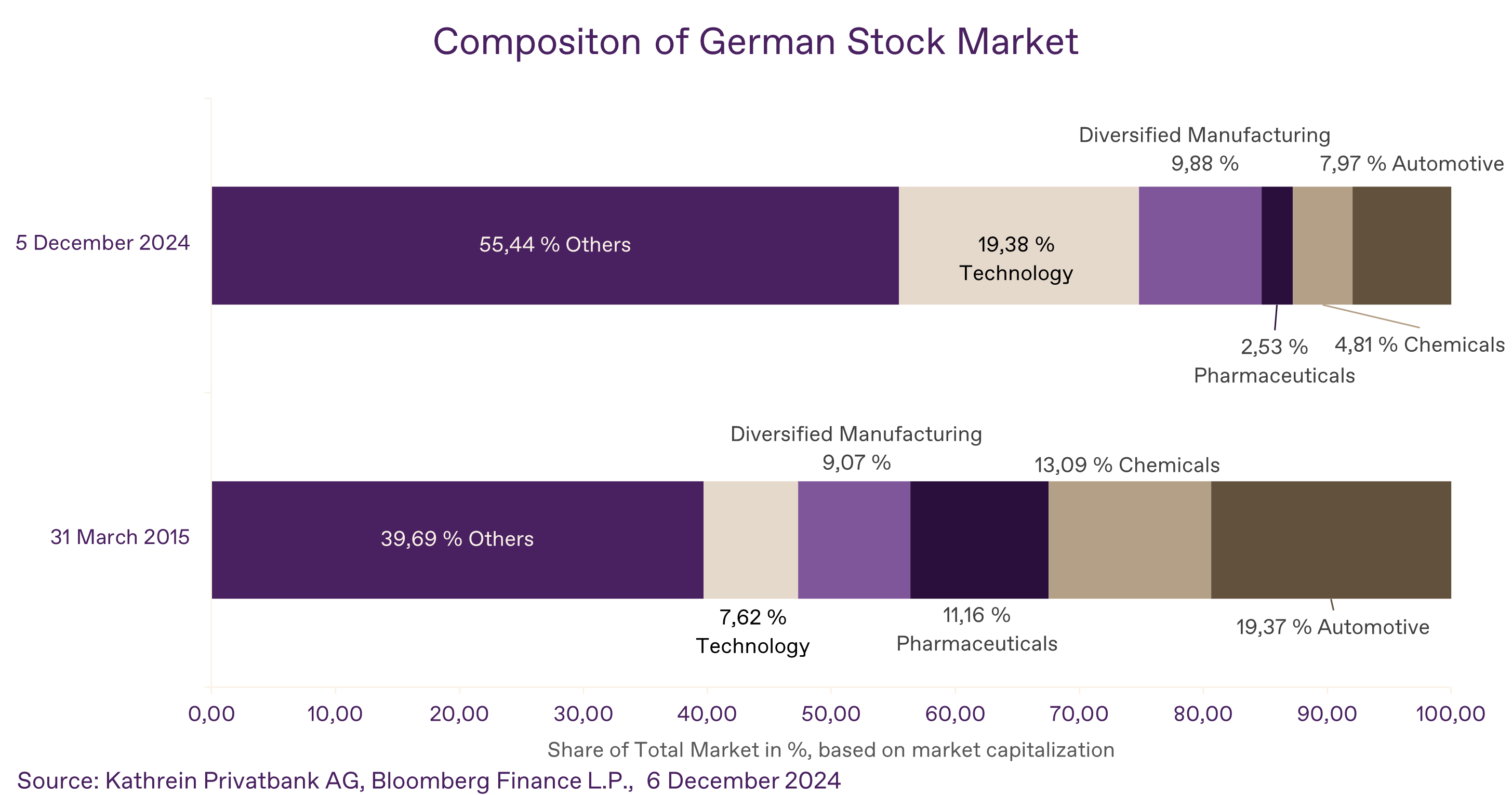

The German benchmark index (DAX) also recently climbed to unprecedented heights and remained unimpressed by the political situation and the extremely negative sentiment in the automotive industry. How does the euphoric stock market sentiment fit with the series of bad news? The explanation lies, among other things, in the current composition of the German stock market. In indices where the components (individual stocks) are weighted by market capitalization, the automotive industry has significantly lost importance in recent years. Comparing the composition of the German stock market (represented by the Bloomberg Germany Large & Mid Cap Price Index, which includes 42 stocks) on December 5, 2024, with the composition on March 31, 2015, this becomes clear. The automotive sector has fallen from first place to fifth place (from around 19% to 8% market capitalization share). At the top now - as in the global environment - are technology stocks. Therefore, to predominantly associate the German stock market with the automotive sector is no longer appropriate.

Bullish Towards the End of the Year

The Kathrein Investment Strategy remains overweight in stocks. Even though we see a bit more reason for caution after the temporary weakness in mid-November 2024, the fundamental economic indicators continue to point to a positive market environment, especially in the USA. Additionally, the stock markets are likely to receive further tailwinds from positive earnings prospects for the final quarter. The further economic development of companies should also benefit from the continuing decline in interest rates. As long as no additional fuel is added to the fire at global geopolitical hotspots, nothing stands in the way of a year-end rally in the stock markets from our perspective.

Disclaimer

This information represents a market overview and the market opinion of Kathrein. It does not constitute financial analysis and does not include any direct or indirect recommendation for the purchase or sale of securities or an investment strategy. When investing in securities, price fluctuations and thus capital losses are always possible. Information and representation of past performance do not allow reliable conclusions about future results. Despite careful research, no guarantee can be given for the accuracy of the data used here.