No end in sight to the gold price rally?

Author - Andreas Weidinger

The price of a troy ounce of gold has risen above the USD 3,000 mark for the first time in history, which warrants a consideration (source: Bloomberg, 21.3.2025). “Au” is the symbol for gold in the periodic table. It has the atomic number 79 and is derived from the Latin word aurum. Gold is one of the heaviest metals, but not the heaviest. It is a precious metal, which means it is corrosion-resistant and chemically stable in a natural environment despite air and water. You probably know some treasure hunter movies in which gold is found deep underground or far below the surface of the sea. After cleaning, it shines in all directions, no matter how old it is. The remarkable thing about gold is that for thousands of years, mankind has been able to agree on using it as a store of value. Whether crypto assets will stand the test of time remains to be seen.

The value of gold

Whether you should hold gold in a portfolio at all is controversial. Warren Buffett believes that gold has no use: “You dig it out of the ground, melt it down, and then you actually bury it again by putting it in a safe and guarding it. If aliens were watching us do this, they would just shake their heads at us.” Then there is the so-called three-prong rule, supposedly from the Talmud: “One should always divide one's wealth into three parts: one-third land, one-third merchandise and one-third cash at hand.” In today's world, this would mean dividing one's wealth into real estate, stocks and gold, each one-third. At Kathrein, we have our own opinion on this and believe that adding gold to a portfolio makes sense. The amount and the way it is done depends on the size of the assets, the investor's risk appetite and the tax situation of the assets. However, you should not expect high real yields over a long period of time. Gold is a good asset class for diversifying risk, relatively independently of movements in the bond and stock markets, but you won't get rich with it. Gold retains its value in real terms over long periods, but it is also prone to bouts of volatility, meaning that prices rise and fall.

More volatile than you think

At the beginning of the millennium, gold was a dying asset class. From its peak of USD 850 in January 1980, it was a long way off at USD 289 per ounce at the beginning of 2000. The low in August 1999, when the price hit 252.55 USD, a drop of just over 70% from its 1980 peak, scared investors away from investing in gold, and central banks reduced their gold reserves during this period. It was not until January 2008 – in the wake of the great financial crisis – that new highs were set in the gold market. From then until September 2011, it continued to rise, only to usher in a new bear market. This time with a price increase of almost 45% and a new high in the summer of 2020 (all data: source: Bloomberg, 21.3.2025). What I want to show you with this is that gold is very volatile and the relative losses in value can be high – so it really has nothing to do with a savings account and nothing to do with the security of a government bond from a country with the best credit rating. What makes gold “safe” are two things: in times of crisis, it is well suited as an independent asset class with its own performance, and as an owner you have no counterparty risk. This is a major difference to government bonds, where the state, i.e. the debtor, might come up with the idea of not paying back everything, extending the term of existing bonds to 100 years, or other things. This is also the reason why emerging market central banks have started buying gold and are refraining from investing their currency reserves in government bonds of developed markets, particularly the US. The freezing of the Russian central bank's USD currency reserves has done the rest.

End of the gold price rally?

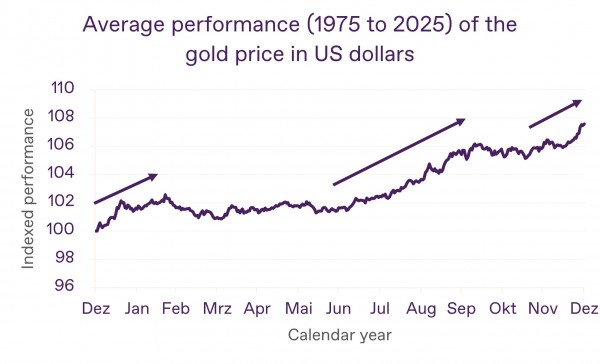

These central bank purchases are a major factor that led to the new high last week. So what will happen next? The arguments remain unchanged: in addition to the central banks, geopolitical uncertainty also supports the gold price. However, gold could also be subject to seasonal fluctuations. Based on data from the last 50 years, the following chart shows the average price development of gold within a calendar year. A certain seasonality can be seen over the last 50 years. On average, gold has risen at the beginning of the year until February and then moved sideways until July. From July until the end of the year, gold has seen the strongest price increase in the course of the year. Some blame the Indian wedding season, which starts in November or December and lasts until February. As we can see, the gold price is subject to many factors. Investors who have added gold to their portfolio should now ask themselves whether the share of gold in their portfolio still meets their expectations after this rally, or whether they should consider rebalancing.

Source: Bloomberg Finance L.P., own calculations, as of March 21, 2025

Disclaimer

This information does not constitute a direct or indirect recommendation to buy or sell gold or securities. When investing in gold or securities, price fluctuations due to market or currency changes are possible at any time. Past performance indicators do not allow reliable conclusions to be drawn about future results.