Is the US dollar really overvalued?

Author - Harald Holzer

In the shadow of erratic US tariff policy, the US dollar is at risk of becoming massively overvalued. Ultimately, however, tariff policy and the strong US dollar are two sides of the same coin. This is because the trade deficit that President Trump wants to combat by means of tariff barriers could also be achieved by devaluing the US dollar. Ironically, it can be assumed that the introduction of tariffs will further strengthen the US dollar against other currencies, which could make the trade balance even more negative. An overheated US dollar also means additional risk for investors, who are already suffering from the unpredictability of US politics. How critical is the situation?

The fair value

The US dollar's rise did not just begin with Trump's re-election; it has been rising against the euro on a trade-weighted basis for many years. The trade-weighted dollar measures the value of the US dollar based on its competitiveness against other trading partners. It is safe to assume that the US dollar will break through parity against the euro and that other currencies will also come under even greater pressure.

The debate about tariffs, trade deficits and “America First” is now once again focusing attention on the strong US dollar. While tariffs are ostensibly used as a means of applying pressure to persuade trading partners to make concessions and to support US producers, a strong dollar has an important side effect: from the American point of view, exports become more expensive and imports cheaper.

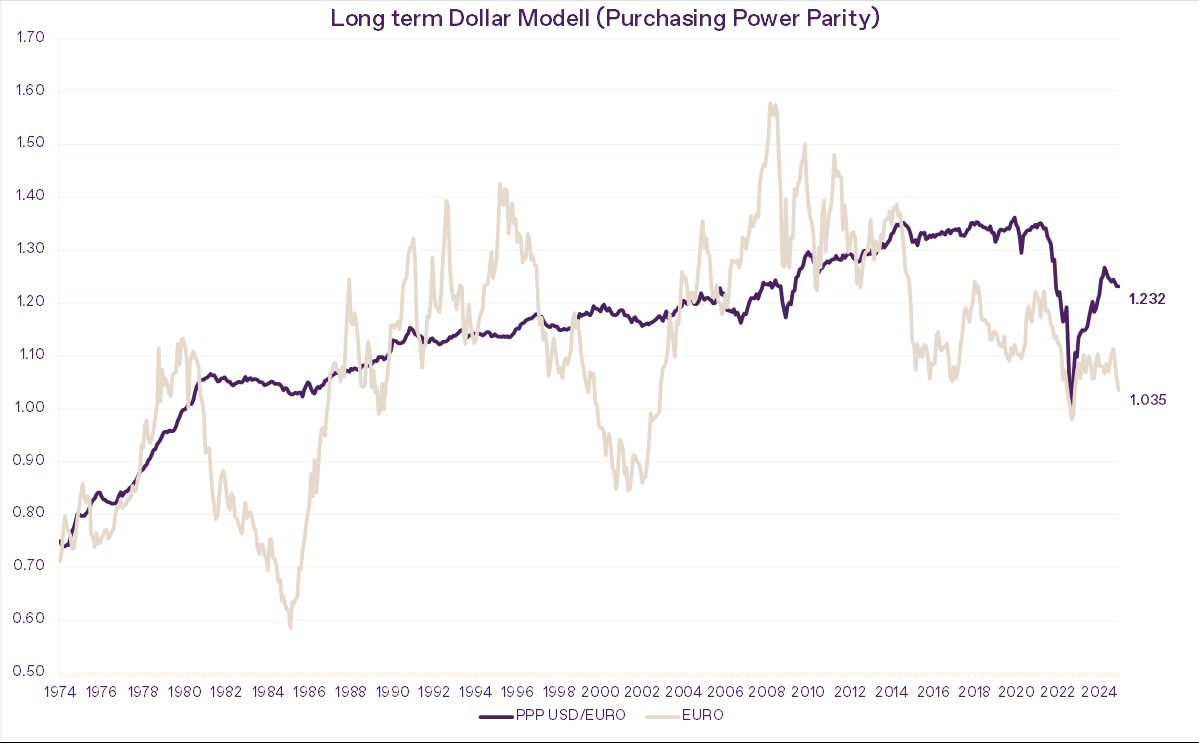

According to common valuation models (e.g. purchasing power parities), the US dollar is currently overvalued by around 15% (see chart, source: Kathrein Privatbank). The purchasing power parity model is based on the idea that the price of a good in different markets is the same when converted into one currency. Based on this theory, there are different models for determining the “fair value” of a currency.

Chart: Purchasing Power Parity US-Dollar vs. Euro, Source Bloomberg and calculations Kathrein, as of February 4, 2025

A look back

Historically, however, there have also been phases in which the US currency deviated significantly further from its “fair value”. In the early 1980s, Germany and Japan were blamed for the high US trade deficit because their currencies were considered too weak. At the time, the US dollar was sometimes even as high as around EUR 0.85 at the time, and thus around 30% above fair value.

This extreme dollar strength led to the 1985 Plaza Accord, a coordinated measure by five leading industrial nations (USA, France, Germany, Japan and Great Britain) that led to a significant devaluation of the US dollar. Such an approach seems no longer likely with today's actors (China would also have to be involved). The US dollar could therefore continue to rise.

Whether we see a repeat of the 1985 level is uncertain. However, if broad-based tariffs are introduced, this could favor a further appreciation of the US dollar. The greenback is still far from the extreme levels of the 1980s. Nevertheless, we are monitoring developments very closely and continue to rely on our proven FX management to respond appropriately to possible fluctuations and shifts in the global trade environment.

Disclaimer

This information represents a market overview and the investment strategy of Kathrein based on our market opinion. It does not constitute a direct or indirect recommendation for the purchase or sale of securities or an investment strategy.

Both currencies and securities are subject to price fluctuations due to market changes at any time. Information and presentation of past performance do not allow any reliable conclusions to be drawn about future results.