European Stocks on the Rise

Author - Josef Stadler, Florian König

For a long time, European stocks were underweight among international major investors in favor of US companies. The dominance of Mega-Caps and higher growth have attracted capital like a magnet. However, signs are increasing that the overweighting of US stocks is being reduced, and the freed-up funds are increasingly being invested in Europe.

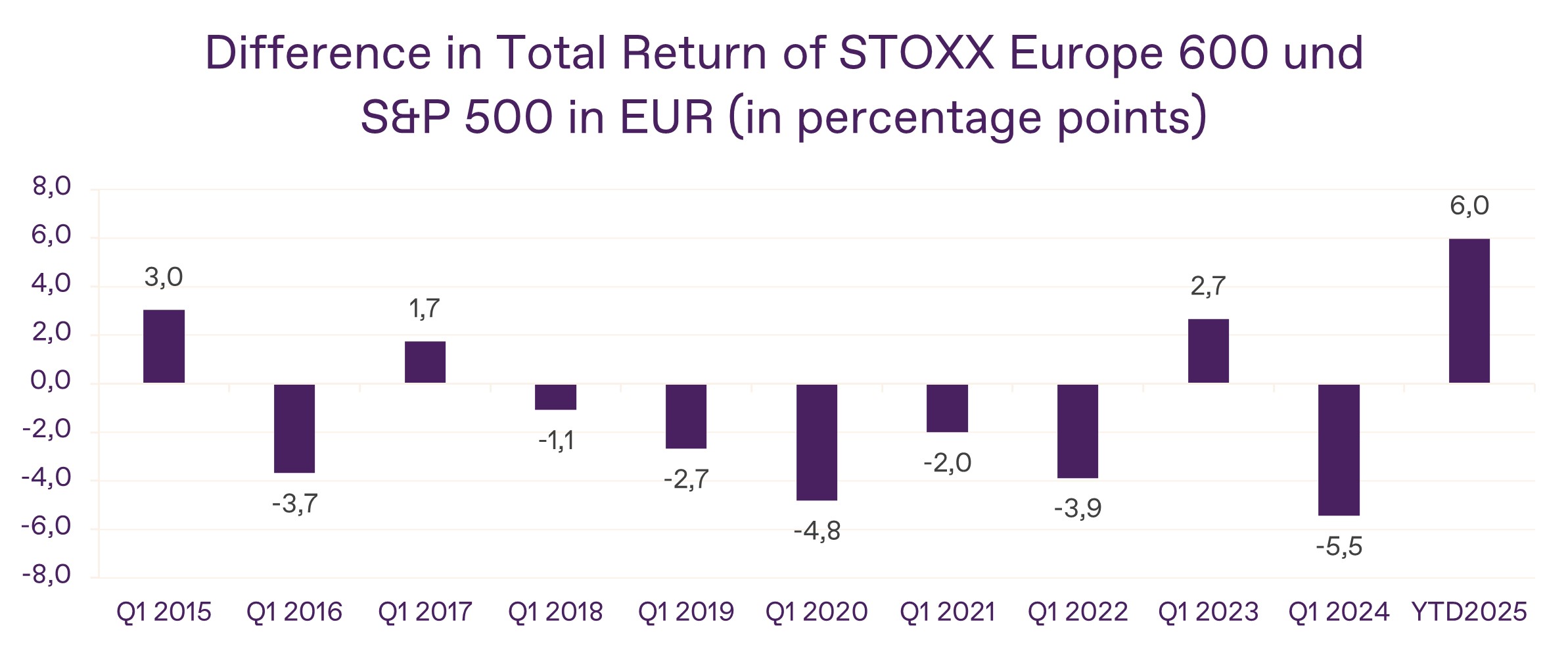

Best Start in a Decade

According to the financial service provider Bloomberg, European stocks recorded the largest inflows since the outbreak of the Ukraine conflict. In just the past week, around 4 billion euros net flowed into European stocks. This explains why European indices have been able to outperform their American counterparts significantly since the beginning of the year. The STOXX Europe 600 Index has already increased by more than 9% in the first eight weeks of this year, while the S&P 500, when calculated in euros, has only risen by 1.4%. If the trend continues, the STOXX Europe 600 is experiencing its best first quarter of a calendar year compared to the S&P 500 from a Euro investor's perspective since 2015.

Source: Bloomberg Finance L.P., Timeframe: First quarter of the respective calendar year, 2025: 31.12.2024 – 20.02.2025. Last update: 21.2.2025. Statements and representations of past performance do not allow for reliable conclusions about future results.

Hope for a ceasefire in the Ukraine conflict and possible fiscal reforms after the election in Germany, as well as the relatively favorable valuation compared to US stocks, provide the arguments for this investor rethinking. Additionally, investors' expectations of further interest rate cuts by the ECB are supportive. We have consistently overweighted Europe in our stock strategy relative to the USA in recent months. Also, the DAX has been given a stronger weight among European stocks, a strategy that is now bearing fruit.Hope for a reduction in bureaucracy in Europe and the political debate on the competitiveness of European companies in the international context are also welcome news.

Geopolitical Question Marks

A significant question mark remains regarding the realignment of US foreign policy in combination with trade policy. The latter can be somewhat compensated for by the weak Euro. Proactive solutions must be implemented to address the former. Hindered by a lack of confidence and unity, the European Union finds itself in a spectator role in geopolitically significant developments. A prompt response to the new circumstances is necessary to avoid being crushed between other major players. Now that the German election has concluded, with the Union of CDU/CSU emerging as the strongest party, many observers anticipate new directions in key areas. Particularly in terms of economic policy, expectations among stakeholders are high. Friedrich Merz is seen as having good chances to initiate the right steps towards relieving businesses and citizens. The tasks for a new government in Germany are indeed immense. Let's hope that coalition negotiations in our neighboring country swiftly lead to an effective government.

Disclaimer

This information provides a market overview and Kathrein's investment strategy based on our market opinion. It does not contain any direct or indirect recommendation for the purchase or sale of securities or an investment strategy.

Both currencies and securities are subject to price fluctuations at any time due to market changes. Statements and performance representations based on the past do not allow for reliable conclusions about future results.