BRICS+: Step toward a new world order?

Author - Michael Wilnitsky

The recently decided expansion of the BRICS group made headlines, especially the goal of replacing the U.S. dollar as the global reserve currency caused a stir. But what are the intentions of this diverse group of democracies and autocracies scattered across four continents? And can this, already diverse, group actually become a powerful collective that challenges the Western world's claim to leadership?

The BRICS group, consisting of Brazil, Russia, India, China and South Africa, was launched in 2006 with informal talks, the inaugural summit took place in 2009 and has since undergone a remarkable evolution. Originally formed to promote economic cooperation and political dialogue among emerging economies, ambitions have since changed to establish BRICS+ as a counterweight to the G7.

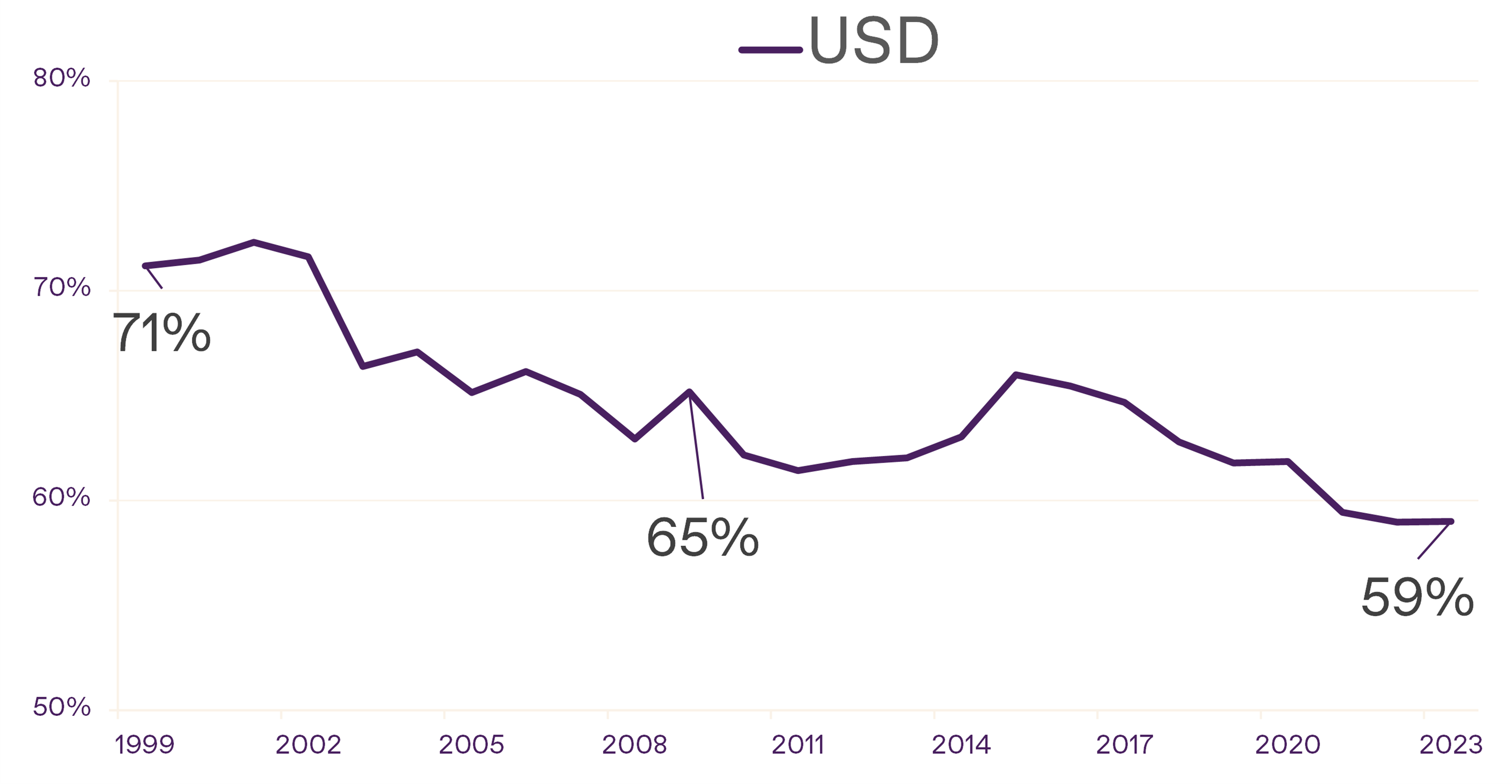

One of the ideas, is to establish a common BRICS currency. This project reflects the members' aspirations to reduce their dependence on the U.S. dollar and achieve greater financial autonomy. Although concrete steps in this direction have been limited so far, the share of USD in global foreign exchange reserves has been steadily declining for a long time. Last but not least, many BRICS members and aspirants are looking to diversify their foreign reserves into other currencies so as not to be too dependent on the United States. This trend signals a growing concern about the impact of dollar dominance on the global economy. Other reasons cited include greater flexibility in trade, and it also allows countries to operate more independently geopolitically and economically.

Share of the U.S. dollar in global foreign exchange reserves

Eleven friends you want to be

An important step in the development of BRICS was the decision to expand the group with new members at the 15th BRICS Summit in South Africa. Saudi Arabia, the United Arab Emirates, Iran, Egypt, Ethiopia, and Argentina were invited to participate in the summit, which can be interpreted as a significant step toward a BRICS+ vision. These new members bring additional economic strength and political influence to the group and underscore efforts to make BRICS+ a broader platform for emerging and developing economies.

Countries' political and economic motivations for joining BRICS+ are diverse. On the one hand, they are looking for new trading partners and markets to diversify and strengthen their own economies. On the other, they are pursuing political goals by joining a group that offers an alternative perspective to the Western-dominated world order. The BRICS countries are eager to strengthen their voices at the international level and make their voices heard in the face of established global powers. Commentators agree, however, that the already diverse group will not gain clout by adding new members. The goals are too different and the tensions within the group are too great; one need only think of China's border conflict with India or the conflicting interests of Russia and China in Africa.

Comeback of the Emerging Markets?

If you look at the figures, however, it becomes clear that BRICS+ is a size in purely economic terms. 37% of global GDP is generated by the 11 countries, the G7 (the western industrialized nations USA; CAN, DE, FRA, GB, IT, JP) come to 30%. After all, 46 % of the world's population lives in BRICS+, in the G7 only just under 10 %. However, mere enlargement will not be able to solve the economic challenges of the growth markets; China in particular is stumbling at the moment. It is not foreseeable that economic problems will be solved by BRICS+. China, however, will continue to advance its hegemonic aspirations. BRICS+ is another building block to break the hegemony of the West. Whether the loose alliance will ultimately lead to a new world order remains more than questionable from today's perspective. In our investment strategy, we remain neutrally weighted in emerging market equities.

Disclaimer

This information is intended to provide a general overview of current market data and market developments and does not constitute a direct or indirect recommendation for a particular investment strategy in the sense of a financial analysis, or a recommendation to buy or sell financial instruments.

When investing in securities, price fluctuations due to market changes are possible at any time. Analysts' opinions, market opinions Data of the performance with reference to the past do not allow reliable conclusions to be drawn about future results.