Is the United States in a recession?

While the President of the US Federal Reserve, Jerome Powell, was still stating on 27 July that the USA was not in a recession, the Bureau of Economic Analysis published a quarterly decline of 0.9% in US gross domestic product (GDP) (on an annualised basis) the very next day - and this for the second time in a row. In Europe, one would already speak of a technical recession, but not so in the USA. Is the US in a recession or not?While the President of the US Federal Reserve, Jerome Powell, was still stating on 27 July that the USA was not in a recession, the Bureau of Economic Analysis published a quarterly decline of 0.9% in US gross domestic product (GDP) (on an annualised basis) the very next day - and this for the second time in a row. In Europe, one would already speak of a technical recession, but not so in the USA. Is the US in a recession or not?

Of course, this is a matter of definition. In Europe, two consecutive quarters of negative growth are considered a technical recession. However, according to the National Bureau of Economic Research (NBER), a US research institution, a recession is a significant decline in economic activity that extends across the entire economy and lasts longer than a few months.economy and lasts longer than a few months - a definition that offers far more leeway and is built on three key criteria: Intensity, scope and duration. These criteria are not yet seen as fulfilled by weighty voices in US politics and, as can be seen, monetary policy makers.

State of the Nation

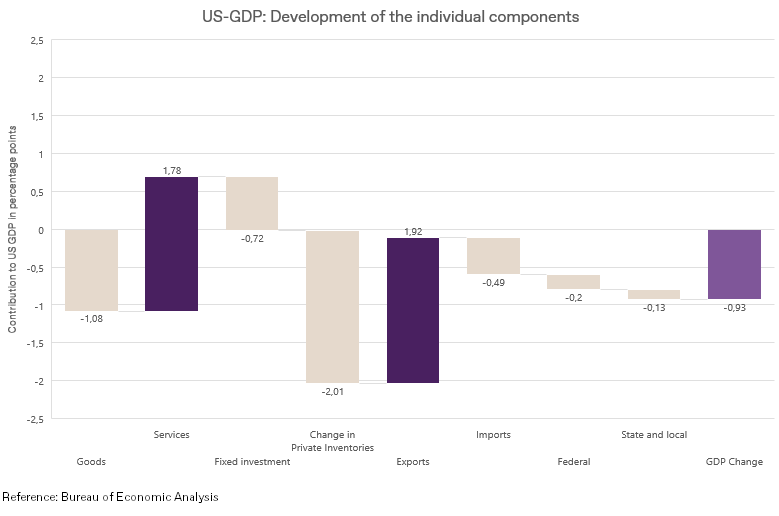

The picture is mixed in the USA. Compared to goods, the service sector benefited from the strong travel activity over the summer months. However, the change in private inventories and inventory investments had a particularly negative effect. It should be emphasised, however, that catch-up effects can be expected in future periods. Real estate investments in the private sector declined in the past quarter. This is primarily due to the rise in interest rates. Extremely good export figures had a positive influence. The picture is mixed in the USA. Compared to goods, the service sector benefited from the strong travel activity over the summer months. However, the change in private inventories and inventory investments had a particularly negative effect. It should be emphasised, however, that catch-up effects can be expected in future periods. Real estate investments in the private sector declined in the past quarter. This is primarily due to the rise in interest rates. Extremely good export figures had a positive influence.

On the bond markets, the publication of data caused a noticeable movement. Thus, the declining interest rate expectations received tailwind. The two-year US yield moved from around 3% to 2.85%. The movement also spilled over to the European region and the German counterpart saw a decline in yields. Equity markets have trended higher since hitting local lows around mid-June 2022 and the renewed decline in US GDP left equity markets largely unaffected. This is primarily due to the advancing earnings season. Around half of US companies published their quarterly results at the end of last week. So far, sales and profit trends have been relatively good, although analysts' expectations for the coming periods have stagnated.

In any case, the market environment remains fast-moving and volatile. It is quite justified to look at all areas of an economy in the context of the overall economic development, such as the US labour market, which continues to be in good shape. However, a close look at the data last quarter showed weakness in consumer spending and business investment. If negative growth is confirmed again in the next quarter, it will be much more difficult to dismiss the decline in economic activity as another temporary dip. The overall macroeconomic development, which from today's perspective is undoubtedly struggling with a slowdown, but which to all appearances is not completely shipwrecked in the current environment, thus remains a key driver of the financial markets and future central bank policy. A soft landing, a decline in economic activity without reaching a recessionary environment, is therefore not excluded. Although the likelihood of this, especially after last Thursday, is becoming less and less likely.

Risk notice

This information is a general overview of current market data and does not contain any direct or indirect recommendation for a specific investment strategy in the sense of a financial analysis. Past performance is not a reliable indicator of future performance of securities. If an investor's base currency is other than USD, the performance also depends on the development of the relevant exchange rate.